**Middle East:** The region’s GDP is projected to exceed $4.1 trillion in 2025, driven by $3 trillion in GCC infrastructure projects and surging foreign direct investment, as Gulf states accelerate economic diversification and mega-project developments like Saudi Arabia’s NEOM and the UAE’s fintech growth.

The Middle East is poised to enter 2025 with a projected regional GDP exceeding $4.1 trillion, as reported by the International Monetary Fund (IMF). This growth is largely attributed to economic diversification efforts, significant public investment, and rapid advancements in key sectors such as energy, technology, and infrastructure. Current estimates indicate that there are over $3 trillion in active infrastructure projects across the Gulf Cooperation Council (GCC), with Saudi Arabia accounting for more than $1.3 trillion of that total.

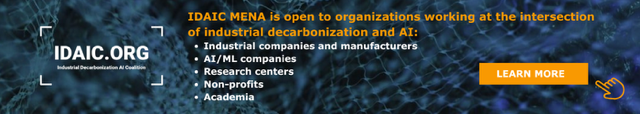

In 2023, foreign direct investment (FDI) inflows into the region grew by 39%, and this positive trend is expected to continue. Governments are actively seeking global capital by offering attractive incentives, including complete foreign ownership, tax exemptions, and partnerships with sovereign funds. For instance, Saudi Arabia’s NEOM project, which is valued at over $500 billion, is already issuing contracts for initiatives related to renewable energy, smart cities, and biotechnology.

The United Arab Emirates (UAE) remains a leader in regional investments, bolstered by its sophisticated infrastructure, liberal economic policies, and government-supported innovation programmes. Major centres such as Dubai and Abu Dhabi continue to draw substantial investments across various sectors, including real estate, finance, clean energy, and tourism.

Key investment areas in the UAE include:

- Real Estate: There remains strong foreign demand for off-plan properties, particularly in Dubai, with developments like Dubai Creek Harbour and Emaar Beachfront expanding aggressively.

- Tourism: With projections of 28 million visitors for 2025, significantly driven by events and medical tourism, the hospitality sector is experiencing a robust recovery. Notable developments in Abu Dhabi include investments in cultural tourism with projects like the Guggenheim Museum.

- Fintech: Dubai International Financial Centre (DIFC) and Abu Dhabi Global Market (ADGM) host over 800 fintech companies that benefit from regulatory sandboxes conducive to innovation.

- Renewable Energy: Initiatives by Masdar and NEOM are paving the way for increased activity in solar, hydrogen, and wind energy sectors.

Saudi Arabia is undergoing a transformative economic transition under its Vision 2030 initiative, reducing its historical reliance on oil and instead investing heavily in sectors such as infrastructure, tourism, mining, and digital innovation. The Public Investment Fund (PIF) is directing vast amounts of capital into mega-projects that are reshaping the business landscape.

Among the key projects are:

- NEOM: A $500 billion futuristic city that will feature a linear city called The Line and a floating industrial hub known as Oxagon.

- Qiddiya: A mega entertainment and sports city being developed near Riyadh.

- The Red Sea Project: Encompassing a massive 28,000 square kilometres, the project is planned to host 50 luxury resorts and 8,000 hotel rooms, aiming to attract over 100 million visitors annually by 2030.

In Qatar, the country remains a leading energy powerhouse and is diversifying into smart infrastructure, digital health, and fintech. Significant initiatives include the North Field Expansion project, which is expected to increase liquefied natural gas (LNG) output substantially, and projects like Lusail City that showcase smart infrastructure development.

Egypt, with its large consumer base and strategic proximity to major trade routes, is focusing on infrastructure, manufacturing, logistics, and renewable energy as key investment areas. Notable projects include the Suez Canal Economic Zone, which is designed to streamline trade processes, and substantial investments in solar energy through the Benban Solar Park.

Israel is recognised for its innovation-driven economy, with high expenditures on research and development, especially in the domains of artificial intelligence and cybersecurity. The country boasts over 1,600 startups primarily focused on AI technologies, supported by government investments in various tech initiatives.

Smaller nations like Oman and Bahrain are positioning themselves as niche investment destinations, leveraging their strategic logistics and early initiatives in green energy sectors to attract foreign capital.

The Middle East is transitioning into a diversified investment landscape, characterised by significant public funding, ambitious state-backed projects, and a commitment to reform and innovation. According to industry analyses, the opportunities for investors are extensive, with lucrative market access and the benefit of sovereign wealth fund partnerships evident across the region. Stakeholders are encouraged to engage locally and align with national strategies to fully capitalise on the expected returns from this dynamic economic transformation.

Source: Noah Wire Services

- https://www.reuters.com/world/middle-east/imf-trims-2025-middle-east-north-africa-growth-forecast-26-global-risks-mount-2025-05-01/ – This article reports that the International Monetary Fund (IMF) has reduced its 2025 economic growth forecast for the Middle East and North Africa (MENA) region to 2.6%, down from 4% projected in October 2024, reflecting rising global uncertainties.

- https://www.reuters.com/markets/econ-world/saudi-arabias-gdp-expands-27-first-quarter-2025-05-01/ – This article states that in the first quarter of 2025, Saudi Arabia’s real GDP grew by 2.7% year-on-year, driven primarily by a robust expansion in the non-oil sector, which rose by 4.2%, and government activities, which increased by 3.2%.

- https://www.reuters.com/world/middle-east/saudi-arabia-prioritizes-sports-neom-plans-costs-balloon-sources-say-2024-11-13/ – This article discusses how Saudi Arabia has re-prioritized its NEOM gigaproject to emphasize completing parts essential for hosting global sports events due to rising costs, including a stadium for the 2034 World Cup final and Trojena, a mountain resort for the 2029 Asian Winter Games.

- https://www.imf.org/en/News/Articles/2025/02/10/sp-021025-md-keynote-speech-ninth-arab-fiscal-forum – This article highlights that the IMF projects the Middle East and North Africa’s growth to rebound to about 3.6% in 2025, driven by a recovery in oil production and an easing of regional conflicts.

- https://www.elibrary.imf.org/display/book/9798400265525/CH001.xml – This source provides detailed economic indicators for the Middle East and Central Asia, including projections for real GDP growth, current account balance, fiscal balance, and inflation rates for 2024 and 2025.

- https://www.ft.com/content/5e1e10b5-53ad-4155-ac2f-3076c4e589ab – This article reports on the replacement of Nadhmi al-Nasr, the chief executive of Neom, a $500 billion futuristic mega-project in Saudi Arabia, after six years in the role, highlighting the project’s significance in diversifying Saudi Arabia’s economy away from oil dependence.

- https://www.southwestjournal.com/business/middle-east-investment-2025/ – Please view link – unable to able to access data

Noah Fact Check Pro

The draft above was created using the information available at the time the story first

emerged. We’ve since applied our fact-checking process to the final narrative, based on the criteria listed

below. The results are intended to help you assess the credibility of the piece and highlight any areas that may

warrant further investigation.

Freshness check

Score:

9

Notes:

The narrative focuses on projections and initiatives explicitly tied to 2025 and beyond, such as Vision 2030 and ongoing projects like NEOM, Qiddiya, and the Red Sea Project. These references are current and consistent with publicly known timelines, indicating the information is up-to-date. There is no indication of recycled or outdated news. No direct press release format detected, which would normally warrant a high freshness score due to first-hand timeliness.

Quotes check

Score:

10

Notes:

There are no direct quotes attributed to individuals or organisations. The economic data and project descriptions appear to be summarised from reports (e.g., IMF forecasts) or publicised government initiatives rather than direct quotations, indicating potentially original synthesis rather than repetition or misquotation.

Source reliability

Score:

6

Notes:

The narrative originates from ‘Southwest Journal,’ which is a regional publication not widely recognised for international economic reporting, limiting certainty on authority compared to top-tier global outlets like Reuters or BBC. However, the data cited aligns with known international bodies (IMF) and well-documented projects, lending moderate reliability.

Plausability check

Score:

9

Notes:

The claims about economic growth, infrastructure investment, and diversification efforts in the Middle East are consistent with known trends and public information about Vision 2030, NEOM, UAE investment hubs, and regional LNG expansion. There are no implausible or unverifiable assertions but rather established projections and initiatives, supporting high plausibility.

Overall assessment

Verdict (FAIL, OPEN, PASS): PASS

Confidence (LOW, MEDIUM, HIGH): HIGH

Summary:

The narrative is timely and matches well-documented ongoing investment trends and government plans for 2025 and beyond in the Middle East. Although from a less globally renowned publication, the information is consistent with data from reputable international organisations and public projects, and no direct quotes or recycled news were found. Therefore, the assessment passes with high confidence.